tax break refund tracker

Once youve filed your federal income tax return you can use the Wheres My Refund tool on the IRS website to track any refund you may be owed. The IRS will determine whether the check was cashed.

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

You can track your refund status on the IRS website or via the IRS mobile app.

. Luckily the millions of people who are getting a payout if they filed their tax returns before the big tax break in the American Rescue Plan became law can track their refund with this IRS tool. However IRS live phone assistance is extremely limited at this time. Americans waiting on their tax refund payment can now track their cash as the IRS rollout has been hit with delays Credit.

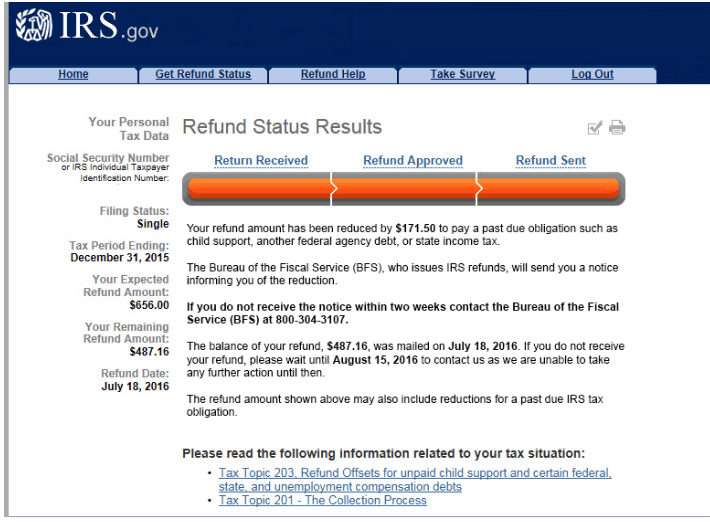

Advertisement Wheres My Tax Refund. Tax Refund Processing. This is available under View Tax Records then click the Get Transcript button and choose the federal tax option.

Wheres my state refund. Another way is to check your tax transcript if you have an online account with the IRS. Check For the Latest Updates and Resources Throughout The Tax Season.

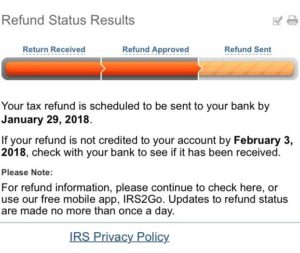

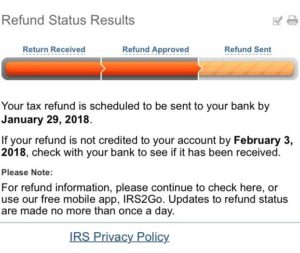

The Wheres My Refund tool will show the status of your tax refund within 24 hours after the IRS receives your e-filed return or four. Lets track your tax refund Once you receive confirmation that your federal return has been accepted youll be able to start tracking your refund at the IRS Wheres My Refund. Generally the IRS issues most refunds in less than 21 days but some may take longer.

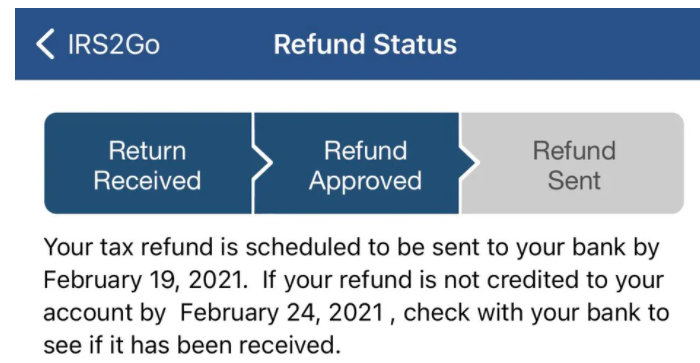

How to use IRS2Go to track your tax refund The IRS also has a mobile app called IRS2Go available for both iOS and Android that checks your tax refund status. Return Received Notice within 24 48 hours after e-file. Track the status of your federal refund on the IRS website.

You can start checking on the status of your refund within 24 hours after the IRS has received your electronically filed return or 4 weeks after you mailed a paper return. Wheres my federal refund. Three or four days after e-filing a tax year 2019 or 2020 return.

Up to 10 cash back Sign in to verify your exact refund amount. Ad Easy and Efficiently Track and Manage all your Tax Filings and Projects in your Office. Use the Wheres My Refund tool or the IRS2Go mobile app to check your refund online.

Your exact whole dollar refund amount. All times are estimated by IRS I mailed my paper return STEP 1. 24 hours after e-filing a tax year 2021 return.

Taxpayers on the go can track their return and refund status on their mobile devices using the free IRS2Go app. 24 hours after e-filing a tax year 2021 return. This is the fastest and easiest way to track your refund.

What You Will Need Social security number or ITIN Your filing status Your exact refund amount Check My Refund Status Wheres My Refund. Taxpayers can select any of the three most recent tax years to check. Will display the status of your refund usually on the most recent tax year refund we have on file for you.

Those who file an amended return should check out the Wheres My Amended Return. Taxpayers can start checking their refund status within 24 hours after an e-filed return is received. Make sure you never miss another filing date and help your firm run smoothly.

The IRS gives some helpful estimates as to when your return will get processed but there are no guarantees. Sadly you cant track the cash in the way you can track other tax refunds. It will create a claims package that includes a copy of the endorsed cashed check if it was indeed cashed.

WASHINGTON The Internal Revenue Service made an important enhancement to the Wheres My Refund. Also make sure its been at least 24 hours or up to four weeks if you mailed your return before you start tracking your refund. Using the IRS tool Wheres My Refund go to the Get Refund Status page.

1 hour ago24 hours after e-filing a tax year 2021 return. You can start checking on the status of you return within 24 hours after the IRS. Click on the button to go right to the IRSs refund tracker for federal tax refunds.

Tracking the status of a tax refund is easy with the Wheres My Refund. Your Social Security numbers. If you e-filed you can start checking as soon as 24 hours after the IRS accepts your e-filed return.

IR-2022-109 May 25 2022. Three or four days after e-filing a tax year 2019 or 2020 return. If you mailed in your return you should wait at least four weeks before checking.

Using Wheres My Refund taxpayers can start checking the status of their refund within. All you need is internet access and this information. Approximately 10million taxpayers may get a 10200 payout if they filed their tax returns before the tax.

You will need your Social security number or ITIN your filing status and your exact refund amount. 3 hours agoUsing the app taxpayers can start checking the status of their refund within. Its available in English and Spanish.

Check the status of your refund. Ad Learn About the Common Reasons for a Tax Refund Delay and What To Do Next. Its conveniently accessible at IRSgov or through the IRS2Go App.

Make sure its been at least 24 hours before you start tracking your refund or up to four weeks if you mailed your return. You can ask the IRS to trace it by calling 800-829-1954 or by filling out and sending in Form 3911 the Taxpayer Statement Regarding Refund. The IRS says it updates payment statuses once per.

Make sure its been at least 24 hours or up to four weeks if you mailed your return before you start tracking your refund. Using the IRS tool Wheres My Refund go. Either way its important to temper your expectations in terms of your wait time.

Download the IRS2Go app to check your refund status. Find out how to check the status of your tax refund in your state. Start checking status 24 48 hours after e-file.

Go to the Get. The systems are updated once every 24 hours. Unfortunately theres no one easy way to check the status of the refunds so it may be a waiting game for most taxpayers.

The best way to check the status your refund is through Wheres My Refund. Four weeks after mailing a return. Tax refund After the IRS accepts your return it typically takes about 21 days to get your refund.

Four weeks after mailing a return. Online tool this week introducing a new feature that allows taxpayers to check the status of their current tax year and two previous years refunds. Once you have e-filed your tax return you can check your status using the IRS Wheres My Refund.

Three or four days after e. You can call the IRS to check on the status of your refund. This tool is also accessible through the IRS2Go mobile app allowing taxpayers to track their refund through three.

Currently you might be waiting a bit longer to receive a refund due to the effects of COVID-19 new tax law changes and possible errors made on the tax return.

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Direct Deposit Payment Delays Aving To Invest

Refund Status Where S My Refund Tax News Information

Wmr And Irs2go Updates And Status Differences Return Received Refund Approved And Refund Sent Latest News And Updates Aving To Invest

Tax Refunds Deadline 2022 How To Track Your Tax Refund Marca

How To Track An Income Tax Refund Turbotax Tax Tips Videos

How To Track Your Tax Refund S Whereabouts Cbs News

Tax Return Refund Delays From The Irs Leave Triangle Residents Waiting For Thousands Of Dollars Abc11 Raleigh Durham

Tax Refund How Long Will It Take For My Return To Be Processed Fingerlakes1 Com

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Wmr And Irs2go Updates And Status Differences Return Received Refund Approved And Refund Sent Latest News And Updates Aving To Invest

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Where S My Refund How To Track Your Tax Refund 2022 Money

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

If Your Tax Refund Check Is Coming In The Mail Here S How To Track It Cnet

Wmr And Irs2go Updates And Status Differences Return Received Refund Approved And Refund Sent Latest News And Updates Aving To Invest

Where S My Refund Where S My Refund Status Bars Disappeared We Have Gotten Many Comments And Messages Regarding The Irs Where S My Refund Tool Having Your Orange Status Bar Disappearing This Has

4 Steps From E File To Your Tax Refund The Turbotax Blog

Waiting On Tax Refund What Return Being Processed Status Really Means Gobankingrates

Irs Refund Tracker Why Is Your Tax Return Still Being Processed Marca